Pis/pasep 2022 – Make your appointment online

Who is entitled to the Salary Supplement Pis/Pasep 2022 You can already see the value you are getting. According to the payment schedule released by the Department of Labor and Social Security.

Private sector workers can start receiving the benefit from February 8th. Public company employees receive them on the 15th of the following month.

Any employee who contributes to the Social Inclusion (PIS) or Wealth Creation in the Public Service (Pasep) programs is entitled to a salary bonus.

This annual benefit ensures that those who meet the legal requirements receive up to a minimum wage. In 2022, the federal government will pay R$ 21.82 billion in Pis/Pasep.

Updated Information About PIS Pasef 2022

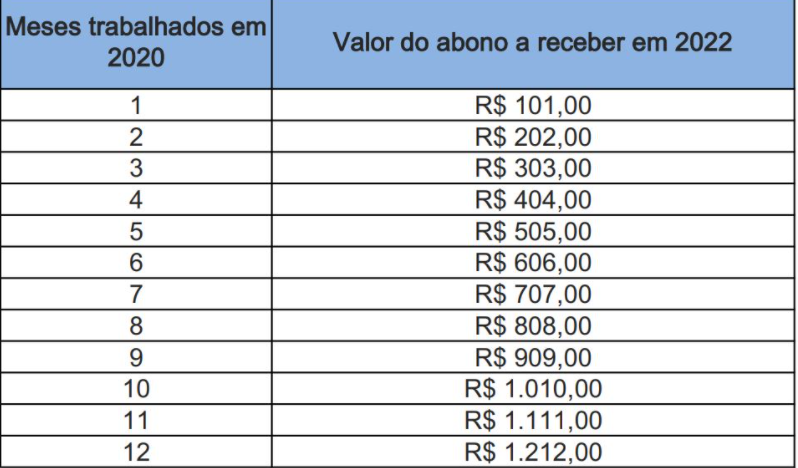

More than 20 million workers are eligible for PIS and 1 million civil servants are eligible for Pasep. The amount to be pocketed varies according to the length of work, but can reach up to R$ 1,212.

The new minimum wage. A double payment from Pis/Pasep was expected, but the 2020 allowance will only be passed on because the payment plan has changed and is anticipated for the first half.

The transfer of Pis/Pasep to the 2021 base year will take place in 2023 according to the redefined calendar.

Who is entitled to Pis/Pasep in 2022?

You must cumulatively meet the following conditions to receive the salary allowance:

Be enrolled in the PIS for at least five years;

Receive an average monthly remuneration of up to two minimum wages during the base year (2020);

Have performed paid activity for a legal entity for at least 30 consecutive or non-consecutive days in the base year (2020) considered for the calculation;

Please inform your employer (legal entity) data correctly in the annual social information report (RAIS)/eSocial.

How to check the Pis/Pasep Balance?

The prospect does not need to leave the house to find out if there is any value related to the Provision Pis/Pasep Year Base 2020. The request can be made online through the Carteira Digital Work application, through the portal www.gov.br and also by calling 158.

The CTPS application is compatible with cell phones with systems compatible with Android or IOS operation. After logging in with your GOV.br credentials (CPF and password).

The next step is to click on Benefits marked with a dollar sign below and view the Salary Allowance.

How can Pis/Pasep be withdrawn in 2022?

Caixa Econômica Federal (employees of private companies) and Banco do Brasil (employees of public companies) act as unemployment insurance payers.

At CEF, payment can be made: credit to the CAIXA account if the employee has a checking, savings or digital account; automatically by CAIXA credit Has a digital social savings account opened by CAIXA;

at ATMs, lottery outlets and CAIXA correspondents.

Here with citizen card and password; at a CAIXA branch upon presentation of an identity document. The employee of the public company can receive the salary bonus in his turnover or savings.

Or even withdraw in person at a BB branch presenting your CPF and RG. It is allowed to carry out TED in another bank account through an ATM or through the website www.bb.com.br/pasep.

What is the amount paid as salary subsidy?

The maximum amount to be received is a minimum wage: R$ 1,212.00. This amount is paid to those who worked a full 12 months in 2020.

But those who worked part-time for just a few months are also entitled to the benefit depending on the hours worked. Cash box:

Pis/Pasep payment schedule

The payment request is made after the birthday month (Pis) or definitive registration number (Pasep). The withdrawal period ends on December 29, 2022. Check the calendar below for each type of beneficiary:

Those born in January can receive from February 8 to December 29, 2022.

Those born in February can withdraw from February 10 to December 29, 2022.

Those born in March can withdraw from February 15th until December 29th, 2022.

Born in April can withdraw from February 17th until December 29th, 2022.

Those born in May can withdraw from February 22nd until December 29th, 2022.

Those born in June can withdraw their benefit from February 24th to December 29th.

Those born in July can withdraw from March 15th to December 29th.

Those born in August can withdraw from March 17th to December 29th.

Those who were born in September can cash out from March 19th until December 29th.

People born in October draw from March 21st to December 29th.

Those born in November can withdraw from March 23rd to December 29th.

And those born in December draw from March 25th to December 29th.

Pis/Pasep Payment Plan

Payment instruction by birthday month (Pis) or final registration number (Pasep). The withdrawal period ends on December 29, 2022. Check the calendar below for each type of beneficiary: